- Welcome to the Doomstead.

Recent posts

#61

Election theft / Trump suggests Republicans sho...

Last post by RE - Feb 06, 2026, 06:28 PM #62

Election theft / Trump Says He’ll Only Accept 2...

Last post by RE - Feb 06, 2026, 06:24 PM

Trump Says He'll Only Accept 2026 Midterms If He Deems Them "Honest"

Trump also said that if the elections aren't "honestly" conducted, "then something else has to happen." The president's judgment on what constitutes an "honest" election is highly suspect, as he has repeatedly peddled falsehoods and debunked conspiracy theories about the results of recent elections.

They're honest if he wins, rigged if he loses. Foolproof.

It can't be any clearer, Trumpolini WILL NOT accept results where the Repugnants lose the CONgressional Majority. He dispatched rioters to contest the last election, this time he's Fascist-in-Chief of the military.

So, will the Generals follow his orders to make sure he wins this one? What will J6P do?

RE

#63

Felon news / Smooth talking motherfucker

Last post by TDoS - Feb 06, 2026, 06:15 PMQuote from: K-Dog on Feb 06, 2026, 05:51 PMI said there would be dead girls a while ago. And now we know Epstein was killed by Trump.

So help me out...how do you get from claim #1 to it proving statement #2?

#64

Felon news / Birds of a feather

Last post by K-Dog - Feb 06, 2026, 05:51 PM

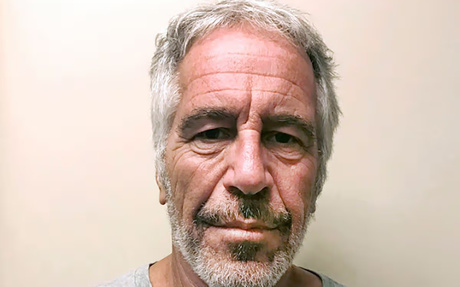

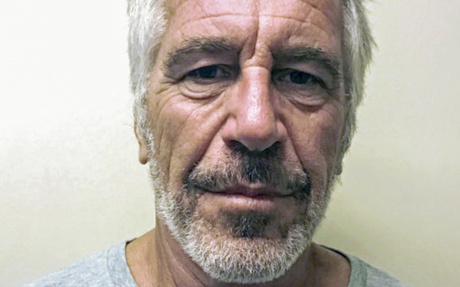

Jeffrey Epstein 'ordered two girls killed during fetish sex to be buried near ranch'

The email - sent by someone claiming to have been employed by Epstein - alleged the victims were strangled to death during "rough, fetish sex" and buried near his New Mexico ranch

I said there would be dead girls a while ago. And now we know Epstein was killed by Trump.

Officials say 'orange shape' on Epstein security cam could show 'unusual' inmate activity the night Epstein died

Officials have said the mysterious orange shape on Jeffrey Epstein's floor spotted on security cam footage the night he died was likely a corrections officer (CO), but newly released documents show that finding was far from a foregone conclusion.

#65

Election theft / The asshole has a contract loo...

Last post by K-Dog - Feb 06, 2026, 05:38 PMQuote from: RE on Feb 06, 2026, 05:16 PMQuote from: TDoS on Feb 06, 2026, 04:08 PMBut that required a decade and being proven right by facts on the ground.

You don't need facts to be a flaming egotist, nor do you even need to be right. You merely need to believe your shit doesn't stink and expect everyone on a website to be grateful you empty your bowels in their presence. It doesn't take a decade to smell it, anyone with decent reading comprehension should pick up the scent by the 3rd post off your keyboard.

RE

Seems his contract with Satan did not cover bodily functions.

#66

Election theft / Trump suggests Republicans sho...

Last post by RE - Feb 06, 2026, 05:16 PMQuote from: TDoS on Feb 06, 2026, 04:08 PMBut that required a decade and being proven right by facts on the ground.

You don't need facts to be a flaming egotist, nor do you even need to be right. You merely need to believe your shit doesn't stink and expect everyone on a website to be grateful you empty your bowels in their presence. It doesn't take a decade to smell it, anyone with decent reading comprehension should pick up the scent by the 3rd post off your keyboard.

RE

#67

Election theft / Trump suggests Republicans sho...

Last post by TDoS - Feb 06, 2026, 04:08 PMQuote from: RE on Feb 05, 2026, 09:32 PMQuote from: TDoS on Feb 05, 2026, 06:07 PMI've been in the know and banned from every doomer website I ever showed up at. For daring to be both happy, and in the know maybe?

For being an insufferable egotist more likely.

RE

Well...maybe. But that required a decade and being proven right by facts on the ground. Before that I was just a troll who didn't understand that Hubbert was right. Not on his 1950 US peak oil call that peakers had never heard of, but the 1970 one. After TOD imploded after being called out by name at national conferences, well, then, maybe...a little ego got involved...sorta.

#68

Election theft / Trump Education Department cra...

Last post by RE - Feb 06, 2026, 01:58 PM

Trump Education Department cracks down on college student voting programs

By repeatedly characterizing data-driven voter engagement as "influencing elections," the administration collapses nonpartisan civic participation work into partisan political activity — a move designed to delegitimize efforts to expand access to the ballot among young voters.

No worries. Straight White Male Property Owners with incomes over $200K will be encouraged to vote twice to make up for a small turnout.

RE

#69

Election theft / ‘Grind the country to a halt’:...

Last post by RE - Feb 06, 2026, 01:33 PM

'Grind the country to a halt': Democrat urges national strike if Trump meddles in midterms

The Democratic senator Ruben Gallego has proposed that, should Donald Trump try to sabotage the midterm elections, Americans should respond with a general strike that would "grind the country to a halt".

If Amerikans had any backbone, a General Strike would have been called after the murders of Pretti & Good. Given most J6Ps live paycheck to paycheck, I doubt most could afford not working much more than a week anyhow. That's not gonna crash the stock market. So I hardly think it's the "Ultimate Response" either. A UR would be something more like the French Model circa 1789.

RE

#70

Election theft / Trump suggests Republicans sho...

Last post by RE - Feb 05, 2026, 09:32 PMQuote from: TDoS on Feb 05, 2026, 06:07 PMI've been in the know and banned from every doomer website I ever showed up at. For daring to be both happy, and in the know maybe?

For being an insufferable egotist more likely.

RE